The income part includes income from every source like salary, pension, reimbursements, dividends from invest meant in the stock market, income from rental property, etc. Components of a Personal BudgetĪ personal budget consists of 3 main components: Income, Expenditure, and Savings. Thus, budgeting is very helpful and should be an important part of our financial management. You can manage your money and make early repayments of your loans and save on interests.Ī personal Budget is nothing but efficient management of your money in such a way that you have enough savings and less or no debts.You start thorough planning, management, and investing money from your savings you can plan your retirement. It provides you with financial freedom.Creating a budget will decrease your stress levels because you will be ready for your upcoming expenses in advance.Planning and monitoring your budget helps you identify the wasteful expenditures.With personal budgeting, you can have money for such unexpected emergencies. In case you don’t have proper money planning you will have to suffer or else increase debt.

Accidents, severe illness, disability, or job loss don’t inform us before coming.As budgeting helps grow our savings, you can use that money for developing skills in this competitive job markets.These include loans, mortgages, credit card debts, etc. Proper personal budgeting can help us get rid of our debts.Moreover, budgeting helps you to plan a better retirement.Be it buying assets like cars, home, gadgets, or luxuries. In case we don’t have a deficit, budgeting helps in achieving our financial goals.The first and foremost thing is that it helps us to keep an eye on our spending.Here are a few things budgeting helps in: Our spending increases more than our incomes and we start to accumulate debt. As a result, we even don’t know when we cross the borderline. Usually, people neglect budgeting in personal financing. Similarly while Budgeting, we track our incomes and expenditures to decrease/cut-down unnecessary or unwanted expenses. During dieting, we make a schedule of what we eat and try to reduce the extra pounds that we have put on.

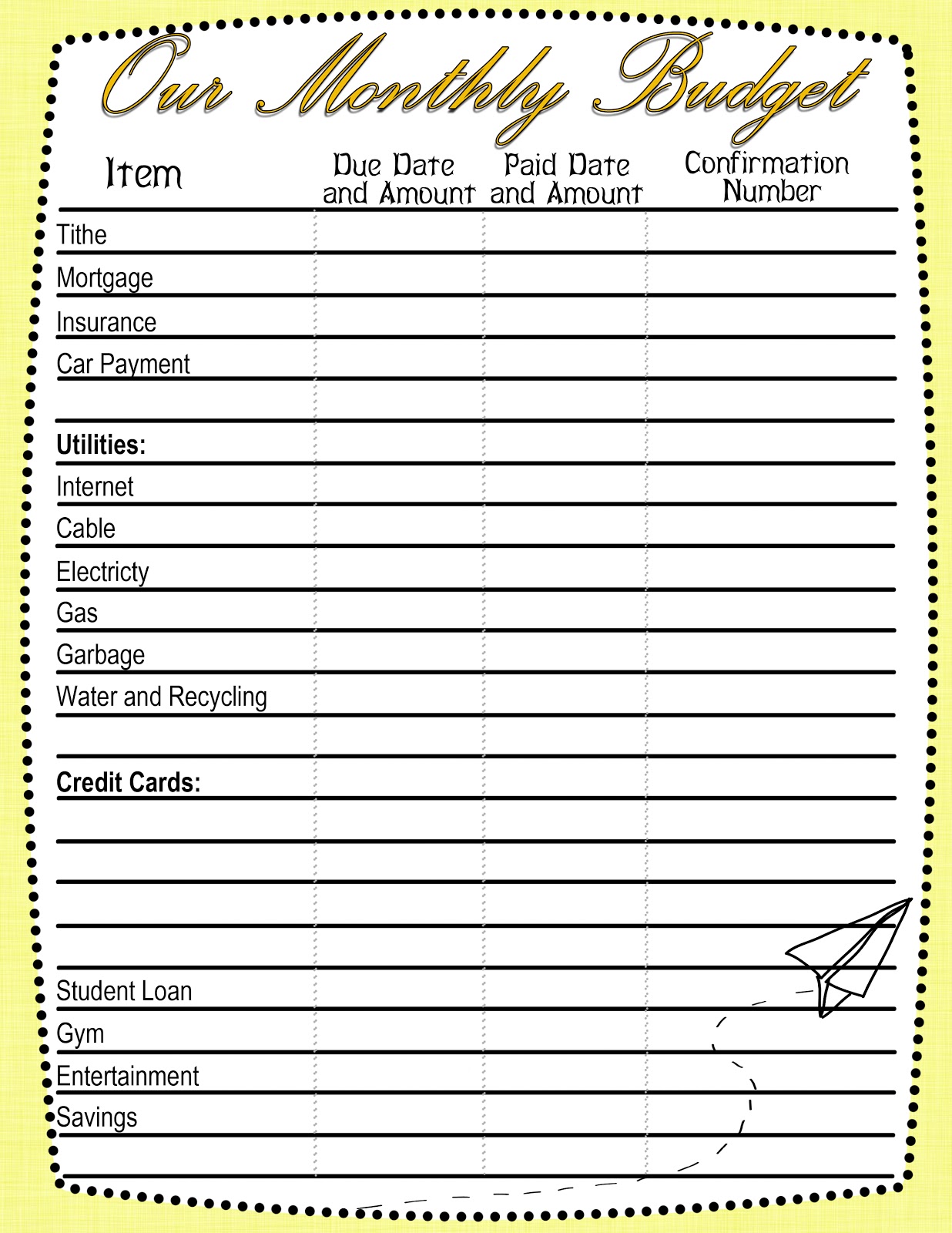

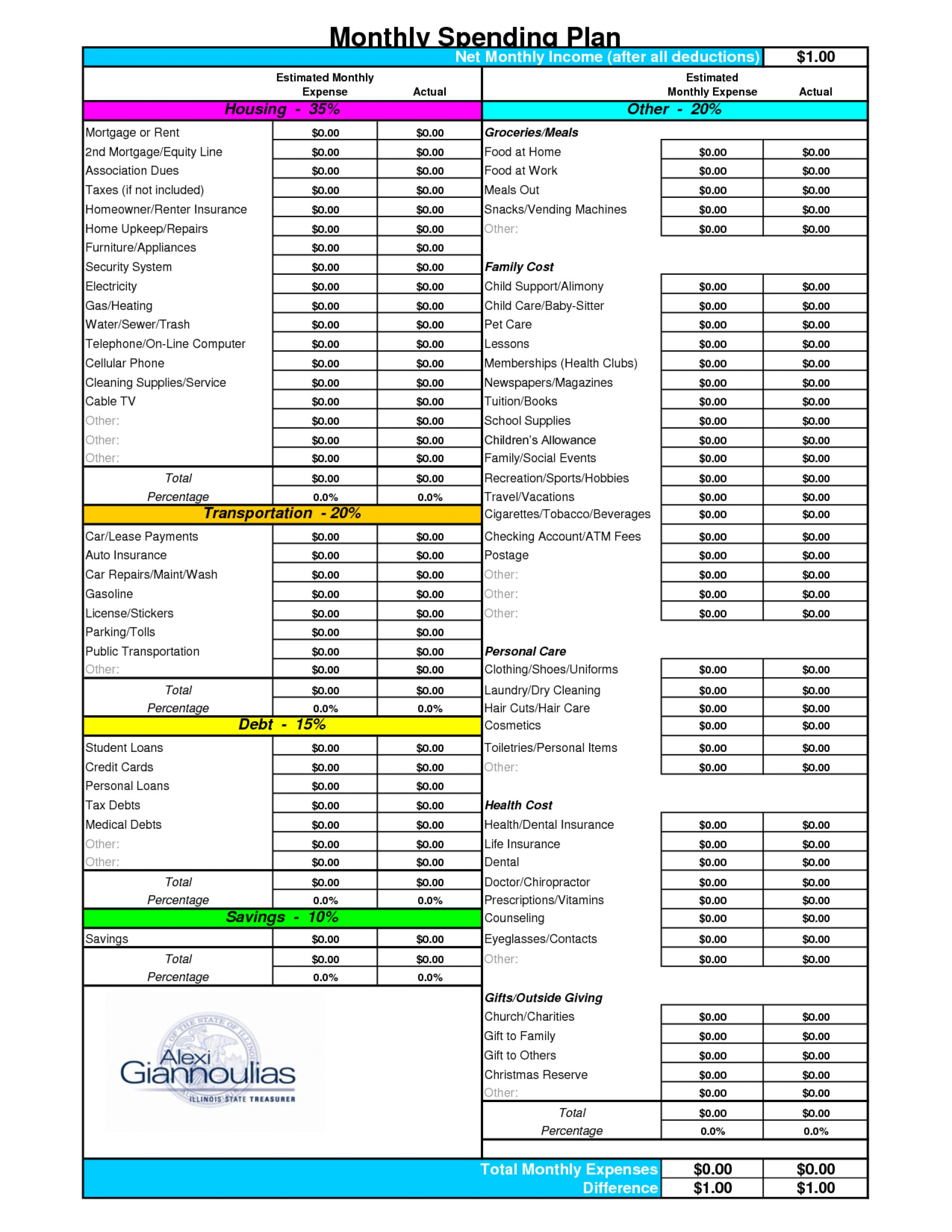

Personal Budget Template (Excel, Google Sheet, OpenOffice)Ī personal budget is a financial plan that allocates your income towards routine expenses eventually helping to do savings or debt repayments.īudgeting is similar to dieting.Home Budget Worksheet - Our original selection of home budget worksheets.Personal Budget Spreadsheet The 12-month version of the personal budget version.Personal Monthly Budget - Like the one above, but less detailed, and designed to fit on a single page.Family Budget Planner - This is the 12-month version of the household budget spreadsheet listed above.Money Management Template - Record transactions to automatically populate the budget vs.If you add or remove any categories, just make sure that the formulas used for the totals don't get messed up. If your Net is negative, that means you have overspent your monthly budget.Īdding or Removing categories: The household budget template contains a very detailed list of categories, which you may or may not need. The Monthly Budget Summary table totals up all your income and expenses and calculates the Net as Income minus Expenses. If you spend more than you budgeted, the Difference between the Projected and Actual values will be negative, and if your Actual income is less than your Projected income, the Difference will be a negative number. In this spreadsheet, the calculations are set up so that negative numbers are bad. The cells in the "Difference" column use conditional formatting to make negative numbers red. At the end of the month, you record in the "Actual" column how much you really spent during the month. This represents your goal - you're trying to keep from spending more than this amount. You record your desired budget for each category in the "Budget" column. The purpose of this worksheet is to help you compare your monthly budget with your actual income and expenses.

#Monthly household budget spreadsheet template how to

You may also want to read the article " How to Budget". Our article " How to Make a Budget" explains how to use these spreadsheets to create your budget. You'll want to replace the values in the Home Expenses category with your own. To use this template, fill in the cells highlighted with a light-blue background (the "Budget" and "Actual" columns). 42 Effective Ways to Save Money Budgeting Tips for the New Year Using the Household Budget Worksheet

0 kommentar(er)

0 kommentar(er)